Exciting news at Samford University! Stephen Black, grandson of Supreme Court Justice Hugo Black, is bringing his course, Poverty, Faith, and Justice, and his SaveFirst program, to our undergraduate curriculum for the Spring of 2018.

Professor Black is the Director for the Center for Ethics and Social Responsibility at the University of Alabama. Following his grandfather's footsteps, he is working to promote civic engagement and connection throughout the United States by connecting college students with concrete opportunities to make a difference in the lives of others.

High income households generally pay licensed tax professionals to prepare their tax returns. The cost of those services is usually below $175. Unfortunately, commercial preparation services charge low income households an average of $400 per return. The preparers are often untrained and fail to take the proper level of care. The cost of these services to Alabama families is $128 million per year.

Through the Poverty, Faith and Justice course, students examine policies and attitudes toward low-income families through readings, class discussions, lectures and work in the community. With no prior tax experience or knowledge, students have the opportunity to learn basic tax law, receive training to become certified as IRS-trained Volunteer Tax Preparers, and assist families in their communities throughout the state through high-quality tax preparation services. Since 2007, 5,418 SaveFirst volunteers have prepared tax returns for 63,154 families, helping them to claim $113.3 million in refunds, saving $20.7 million in fees.

Another ImpactAmerica program, FocusFirst,

has screened pre-school age children for vision problems. Since 2004

3,557 student volunteers have screened 432,830 preschoolers, identifying

44,696 children with vision problems, and connecting them with

optometrists and ophthalmologists to address their needs. Through Impact America, Professor Black has extended the geographic reach of the programs he developed with ImpactAlabama to Florida, South Carolina, Tennessee, and Philadelphia.

Many thanks to the Mann Center for Ethics and Leadership for making this opportunity possible.

Wednesday, November 22, 2017

Friday, September 8, 2017

Tax Brackets and Why You Shouldn't Fear a Raise

I enjoyed a few seconds in the national spotlight this week when Adrienne Hill interviewed me for a piece on tax brackets for National Public Radio's Marketplace: Tax brackets and why you shouldn't fear a raise

I enjoyed a few seconds in the national spotlight this week when Adrienne Hill interviewed me for a piece on tax brackets for National Public Radio's Marketplace: Tax brackets and why you shouldn't fear a raiseFor more on the history of the U.S. income tax system, tax brackets and rates, see my 2014 article, Brackets: A Historical Perspective.

Wednesday, August 30, 2017

100+ Years of the Income Tax: Putting Income Tax Reform in Context

|

| This year I donned my suffragette outfit in honor of the 16th Amendment, ratified in 1913. |

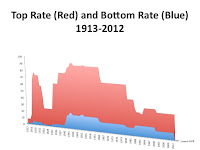

As we walk through the changes in rates over time, I ask my students to explain what was happening in U.S. history during each decade and consider how those events may have affected the tax system.

This gives us an opportunity to talk about the federal budget, budget deficits, the federal debt, fairness, efficiency, complexity and incentives. This is especially fun when tax reform is part of the Congressional agenda.

Fortunately, the history of the income tax holds some surprises. . . .

- Marginal Rates. The highest marginal income tax rate was 94% (during WWII) and the lowest marginal rate was 1% (during the first few years of the income tax).

Today our bottom rate is 10% and our top rate is 39.6% on ordinary income. The top capital gains rate is 20%. There is also a separate 3.8% rate applied to net investment income. - Level of Income to which Top Rates Applied. Just prior to WWII, the top rate, 81%, was applied to incomes in excess of $80 million (in today's dollars). Today, the top rate of 39.6% is applied to ordinary income in excess of $418,400 (for unmarried individuals) or $470,000 (for couples who are married filing jointly).

- Number of Brackets. We have had as many as 56 rates and tax brackets (during WWI and WWII) and as few as 3 (after the Tax Reform Act of 1986).

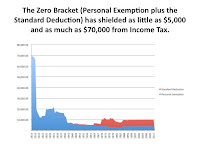

- Personal Exemption and Standard Deduction. We have always exempted some income from the scope of the income tax. For the first few years The income tax was levied only against incomes in excess of $70,000 (in today's dollars). This year the standard deduction plus the personal exemption is $10,400 for an unmarried individual.

- Inflation. We have a system of graduated rates. In general, an unmarried individual will not pay income tax on his first few dollars of earnings because the standard deduction and personal exemption shield that income from tax. The next $9,350 is taxed at 10%, the next $28,625 is taxed at 15%, the next $53,950 is taxed at 25%, and so on for the 28%, 33%, and 35% rates until 39.6% is applied to individual income in excess of $418,400.

The brackets are adjusted for inflation each year. However, that hasn't always been the case. Before 1981, Congress set the rates at specified dollar amounts. As inflation reduced the purchasing power of the dollar each year, higher rates were levied against lower and lower amounts of real income.

The downward curves show the

impacts of inflation.

In 1965 the top rate of 70% was applied to incomes in excess of $784,000 (in today's dollars). By 1981, the rates and brackets had not been changed significantly, but because of inflation the top rate of 70% was being applied to real incomes of only about $281,000 (in today's dollars).

Congress enjoyed an annual tax increase without having to pass tax legislation. Yikes! Fortunately, with the Tax Reform Act of 1981, we began adjusting the brackets and rates to reflect inflation.- War. During wars we have always increased rates, except for 2001, when we began the war in Afghanistan, and 2003, when we began the war in Iraq. Instead of increasing rates, Congress passed tax cuts in these years.

Saturday, April 8, 2017

Legal Executives at Tech Firms Promote Federal Funding for Legal Aid

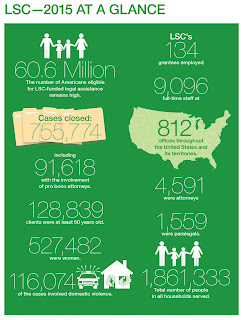

Top legal executives at Cisco, Juniper Networks, Hewlett Packard Enterprise, Microsoft, Google, Salesforce.com, Symantec, Verizon, Comcast, Yahoo, LinkedIn, NetApp, Adobe, Facebook and Twitter speak out against the defunding of Legal Services Corporation, the government organization that provides funding for civil legal services for low income Americans.

Top legal executives at Cisco, Juniper Networks, Hewlett Packard Enterprise, Microsoft, Google, Salesforce.com, Symantec, Verizon, Comcast, Yahoo, LinkedIn, NetApp, Adobe, Facebook and Twitter speak out against the defunding of Legal Services Corporation, the government organization that provides funding for civil legal services for low income Americans. Legal Services Corporation (LSC) is an independent nonprofit established by Congress in 1974 to provide financial support for civil legal aid programs that help low-income Americans. Legal aid programs ensure access to justice by providing free legal help to households with annual incomes at or below 125% of the federal poverty guidelines. Clients include the working poor, veterans and military families, homeowners and renters, families with children, farmers, the disabled, and the elderly.

Wednesday, March 29, 2017

18th Global Conference on Environmental Taxation

Tucson, Arizona, U.S.A. - September 27-29, 2017

Call for Papers/Abstracts

Please plan ahead for the 18th Global Conference on Environmental Taxation! The deadline for submitting abstracts in response to the Call for Papers is May 1, 2017 and early submissions are welcome. For information about the conference and the Call for Papers, click here.

This year the conference's focus is: Innovation Addressing Climate Change Challenges: Local and Global Perspectives

We are in a pivotal and defining time for global discourse on public/private sector response at all levels of government (national, state, indigenous, provincial, municipal, city, and local), to the impacts of climate change. And, GCET18 is well-positioned in its role as the leading global forum for innovative exchanges on principles, practices, and policies with respect to environmental taxation and market-based instruments.

The conference will explore various topics :

This year the conference's focus is: Innovation Addressing Climate Change Challenges: Local and Global Perspectives

We are in a pivotal and defining time for global discourse on public/private sector response at all levels of government (national, state, indigenous, provincial, municipal, city, and local), to the impacts of climate change. And, GCET18 is well-positioned in its role as the leading global forum for innovative exchanges on principles, practices, and policies with respect to environmental taxation and market-based instruments.

The conference will explore various topics :

- Climate change policy, biodiversity protection, environmental stewardship, pollution control, water conservation, land degradation, renewable energy, mining and rehabilitation

- Market instruments such as carbon pricing, emissions trading schemes, other environmental taxes, subsidies, direct action or spending programs and tax concessions both positive and perverse.

Selected papers from the Global Conferences are published in Critical Issues in Environmental Taxation.

The conference this year will be hosted by the University of Arizona, James E. Rogers College of Law, and the Conference Chair is Mona Hymel. If you have questions, please contact her at law-gcet18@list.arizona.edu.

We hope to see you in Tucson!

The conference this year will be hosted by the University of Arizona, James E. Rogers College of Law, and the Conference Chair is Mona Hymel. If you have questions, please contact her at law-gcet18@list.arizona.edu.

We hope to see you in Tucson!

Tuesday, February 14, 2017

Announcing TaxJazz: The Tax Literacy Project!

TaxJazz: The Tax Literacy Project has launched its new website. TaxJazz provides individuals with non-partisan, non-technical, and accessible tax information to help people participate in discussions about tax policy and problems facing the nation. TaxJazz already addresses basic tax questions, such as: Why do we have taxes? Are there any legal constraints on taxation? What can be taxed? How do we decide what is a fair tax?

TaxJazz: The Tax Literacy Project has launched its new website. TaxJazz provides individuals with non-partisan, non-technical, and accessible tax information to help people participate in discussions about tax policy and problems facing the nation. TaxJazz already addresses basic tax questions, such as: Why do we have taxes? Are there any legal constraints on taxation? What can be taxed? How do we decide what is a fair tax?The TaxJazz readings, worksheets, dialogues and other materials have been used by individuals between the ages of 12 and 80 and groups in a variety of different settings including high schools, a city recreation department’s after-school program, and community senior centers. With its website, TaxJazz will now be able accessible to anyone who has a computer.

For more information, contact us!

Saturday, January 14, 2017

Tillerson Errs on Tax Subsidies for Fossil Fuels

On Thursday, as part of the confirmation hearings for Secretary of State for the Trump Administration, Rex Tillerson, CEO of Exxon Mobil, appeared before the Senate Foreign Relations Committee.

Jeanne Shaheen (D -New Hampshire) asked Tillerson whether he thought subsidies given to the oil and gas industry were still necessary, given the record profits that the industry is now earning: "At this time, when many of our oil companies, particularly large oil companies like Exxon, are reaping very good profits, do we really need to continue these subsidies?"

Shaheen noted that in 2009 the G20 (the Group of 20 industrialized nations) had pledged to phase out fossil fuels and asked if Tillerson and the Department of State would fulfill that pledge.

Tillerson denied that oil, gas and coal receive tax subsidies, responding, "I'm not aware of anything the fossil fuel industry gets that I would characterize as a subsidy. It's simply the application of the tax code broadly — tax code that broadly applies to all industry. ... So I'm not sure what subsidies we're speaking of."

Fossil fuels have enjoyed a continuing infusion of special tax subsidies for over 100 years.

Oil, gas and coal industries *do* receive many subsidies that are shared with other industries. They include provisions under Sections 167 and 168, for accelerated depreciation, and Section 199, the domestic production deduction. They share the benefit of tax-exempt bonds for certain public energy-related projects under Section 103, and for certain private energy-related projects under Sections 141 and 142 with renewable energy developments. Several tax credits are shared with other groups in the energy sector, such as the Energy Research Credit under Section 41, and the Gasification Credit, under Section 48B, which provides a benefit to qualified projects to convert coal, petroleum residue, biomass, or other materials into a synthetic gas.

Fossil fuel companies also enjoy a special exemption from the corporate tax. While, generally, publicly traded entities are subject to the corporate tax, section 7704(c) and Section 851 permit fossil fuel investors to enjoy pass-through taxation, avoiding the corporate “double tax.” Public trading makes the investments highly liquid and minimizes information and transaction costs. The structures are permanent and lend significant legislative certainty to investors about the tax benefits they are to receive. The fact that this special subsidy is also enjoyed by those with timber interests and the financial services industry does not make it any less a subsidy.

Others sometimes suggest that deferring or delaying the payment of tax does not provide a benefit. For example, a contributor to Forbes, Tim Worstall, recently argued that deferring or delaying paying taxes is not really a subsidy. Most businesses understand the time value of money and use it to their advantage. In the simplest terms, if I pay taxes today, those are funds gone from my pocket and I cannot spend them on anything else. On the other hand, if I can defer paying a sum for five or ten years, I can invest the sum, enjoy gains from compound interest (or better yet capital gains), and still pay the tax at a later date. Delaying and deferring can result in substantial tax savings. Plus, firms that use loans finance their investments gain an even higher return and pay even lower taxes, since they enjoy the tax benefits today, but delay any actual outlays of cash to make these investments until they repay their loans. By using debt financing to purchase equipment that is subject to accelerated depreciation or expensing, a firm can enjoy a negative tax rate.

There are also many tax subsidies that are exclusive to fossil fuels. Oil, gas and coal may claim deductions in excess of their investment through percentage depletion under Sections 611-613A and 291. They may deduct certain expenses immediately when they would otherwise be required to capitalize and recover their investments over time. These include a deduction for tertiary injectants (fracking fluids) under Section 193, and an election to expense intangible drilling costs (under Sections 263(c) and 291). Certain coal royalties enjoy reduced tax rates under Section 631(c). The fossil fuel industry is allowed to treat royalty payments as foreign taxes paid, applying the foreign tax credit to offset U.S. income taxes. They also benefit from special credits, such as the advanced coal project credit (Section 48A), the Indian coal credit (Section 45), the enhanced oil recovery (EOR) credit (Section 43), the marginal wells credit (Section 45I), and the carbon dioxide sequestration credit (Section 45Q) Fossil fuels enjoy exemptions from the application of certain rules. Working interests in oil and gas property enjoy an exception to the passive activity loss rules under Section 469. There is a safe harbor from arbitrage rules for prepaid natural gas contacts under Section 148. Finally, they receive subsidies to support environmental compliance. There is a safe harbor from arbitrage rules for prepaid natural gas contacts under Sec. 148. Finally, they receive subsidies to support environmental compliance. All of these subsidies are explained in more detail in my 2016 article "Picking Winners and Losers: A Structural Examination of Tax Subsidies to the Energy Industry."

While occasionally people will suggest that tax benefits are not really subsidies, this notion has been long discredited. As Dan Shaviro is fond of saying, Congress can give a grant of $2 million to the aerospace industry to design a fighter jet or it can grant a $2 million tax credit for that fighter jet. The benefit to the industry is the same. Congress appears to prefer tax subsidies to direct spending because people succumb to the "tax benefit is not a subsidy" fallacy, because the subsidies are less visible and because they are not scrutinized and fought over each year the way the federal budget is.

Eliminating the tax subsidies to fossil fuels would save approximately $26 billion in tax revenues over five years. This sum may seem rather modest in the context of budgetary spending. However, when we take into account all of the extensive health and other social and environmental impacts, giving subsidies to fossil fuels is not only wasteful, but ludicrous.

Jeanne Shaheen (D -New Hampshire) asked Tillerson whether he thought subsidies given to the oil and gas industry were still necessary, given the record profits that the industry is now earning: "At this time, when many of our oil companies, particularly large oil companies like Exxon, are reaping very good profits, do we really need to continue these subsidies?"

Shaheen noted that in 2009 the G20 (the Group of 20 industrialized nations) had pledged to phase out fossil fuels and asked if Tillerson and the Department of State would fulfill that pledge.

Tillerson denied that oil, gas and coal receive tax subsidies, responding, "I'm not aware of anything the fossil fuel industry gets that I would characterize as a subsidy. It's simply the application of the tax code broadly — tax code that broadly applies to all industry. ... So I'm not sure what subsidies we're speaking of."

Fossil fuels have enjoyed a continuing infusion of special tax subsidies for over 100 years.

Oil, gas and coal industries *do* receive many subsidies that are shared with other industries. They include provisions under Sections 167 and 168, for accelerated depreciation, and Section 199, the domestic production deduction. They share the benefit of tax-exempt bonds for certain public energy-related projects under Section 103, and for certain private energy-related projects under Sections 141 and 142 with renewable energy developments. Several tax credits are shared with other groups in the energy sector, such as the Energy Research Credit under Section 41, and the Gasification Credit, under Section 48B, which provides a benefit to qualified projects to convert coal, petroleum residue, biomass, or other materials into a synthetic gas.

Fossil fuel companies also enjoy a special exemption from the corporate tax. While, generally, publicly traded entities are subject to the corporate tax, section 7704(c) and Section 851 permit fossil fuel investors to enjoy pass-through taxation, avoiding the corporate “double tax.” Public trading makes the investments highly liquid and minimizes information and transaction costs. The structures are permanent and lend significant legislative certainty to investors about the tax benefits they are to receive. The fact that this special subsidy is also enjoyed by those with timber interests and the financial services industry does not make it any less a subsidy.

Others sometimes suggest that deferring or delaying the payment of tax does not provide a benefit. For example, a contributor to Forbes, Tim Worstall, recently argued that deferring or delaying paying taxes is not really a subsidy. Most businesses understand the time value of money and use it to their advantage. In the simplest terms, if I pay taxes today, those are funds gone from my pocket and I cannot spend them on anything else. On the other hand, if I can defer paying a sum for five or ten years, I can invest the sum, enjoy gains from compound interest (or better yet capital gains), and still pay the tax at a later date. Delaying and deferring can result in substantial tax savings. Plus, firms that use loans finance their investments gain an even higher return and pay even lower taxes, since they enjoy the tax benefits today, but delay any actual outlays of cash to make these investments until they repay their loans. By using debt financing to purchase equipment that is subject to accelerated depreciation or expensing, a firm can enjoy a negative tax rate.

There are also many tax subsidies that are exclusive to fossil fuels. Oil, gas and coal may claim deductions in excess of their investment through percentage depletion under Sections 611-613A and 291. They may deduct certain expenses immediately when they would otherwise be required to capitalize and recover their investments over time. These include a deduction for tertiary injectants (fracking fluids) under Section 193, and an election to expense intangible drilling costs (under Sections 263(c) and 291). Certain coal royalties enjoy reduced tax rates under Section 631(c). The fossil fuel industry is allowed to treat royalty payments as foreign taxes paid, applying the foreign tax credit to offset U.S. income taxes. They also benefit from special credits, such as the advanced coal project credit (Section 48A), the Indian coal credit (Section 45), the enhanced oil recovery (EOR) credit (Section 43), the marginal wells credit (Section 45I), and the carbon dioxide sequestration credit (Section 45Q) Fossil fuels enjoy exemptions from the application of certain rules. Working interests in oil and gas property enjoy an exception to the passive activity loss rules under Section 469. There is a safe harbor from arbitrage rules for prepaid natural gas contacts under Section 148. Finally, they receive subsidies to support environmental compliance. There is a safe harbor from arbitrage rules for prepaid natural gas contacts under Sec. 148. Finally, they receive subsidies to support environmental compliance. All of these subsidies are explained in more detail in my 2016 article "Picking Winners and Losers: A Structural Examination of Tax Subsidies to the Energy Industry."

While occasionally people will suggest that tax benefits are not really subsidies, this notion has been long discredited. As Dan Shaviro is fond of saying, Congress can give a grant of $2 million to the aerospace industry to design a fighter jet or it can grant a $2 million tax credit for that fighter jet. The benefit to the industry is the same. Congress appears to prefer tax subsidies to direct spending because people succumb to the "tax benefit is not a subsidy" fallacy, because the subsidies are less visible and because they are not scrutinized and fought over each year the way the federal budget is.

Eliminating the tax subsidies to fossil fuels would save approximately $26 billion in tax revenues over five years. This sum may seem rather modest in the context of budgetary spending. However, when we take into account all of the extensive health and other social and environmental impacts, giving subsidies to fossil fuels is not only wasteful, but ludicrous.

Subscribe to:

Posts (Atom)