|

| This year I donned my suffragette outfit in honor of the 16th Amendment, ratified in 1913. |

As we walk through the changes in rates over time, I ask my students to explain what was happening in U.S. history during each decade and consider how those events may have affected the tax system.

This gives us an opportunity to talk about the federal budget, budget deficits, the federal debt, fairness, efficiency, complexity and incentives. This is especially fun when tax reform is part of the Congressional agenda.

Fortunately, the history of the income tax holds some surprises. . . .

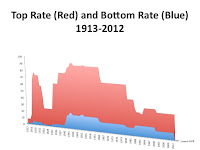

- Marginal Rates. The highest marginal income tax rate was 94% (during WWII) and the lowest marginal rate was 1% (during the first few years of the income tax).

Today our bottom rate is 10% and our top rate is 39.6% on ordinary income. The top capital gains rate is 20%. There is also a separate 3.8% rate applied to net investment income. - Level of Income to which Top Rates Applied. Just prior to WWII, the top rate, 81%, was applied to incomes in excess of $80 million (in today's dollars). Today, the top rate of 39.6% is applied to ordinary income in excess of $418,400 (for unmarried individuals) or $470,000 (for couples who are married filing jointly).

- Number of Brackets. We have had as many as 56 rates and tax brackets (during WWI and WWII) and as few as 3 (after the Tax Reform Act of 1986).

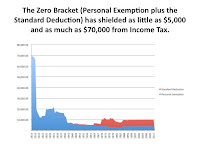

- Personal Exemption and Standard Deduction. We have always exempted some income from the scope of the income tax. For the first few years The income tax was levied only against incomes in excess of $70,000 (in today's dollars). This year the standard deduction plus the personal exemption is $10,400 for an unmarried individual.

- Inflation. We have a system of graduated rates. In general, an unmarried individual will not pay income tax on his first few dollars of earnings because the standard deduction and personal exemption shield that income from tax. The next $9,350 is taxed at 10%, the next $28,625 is taxed at 15%, the next $53,950 is taxed at 25%, and so on for the 28%, 33%, and 35% rates until 39.6% is applied to individual income in excess of $418,400.

The brackets are adjusted for inflation each year. However, that hasn't always been the case. Before 1981, Congress set the rates at specified dollar amounts. As inflation reduced the purchasing power of the dollar each year, higher rates were levied against lower and lower amounts of real income.

The downward curves show the

impacts of inflation.

In 1965 the top rate of 70% was applied to incomes in excess of $784,000 (in today's dollars). By 1981, the rates and brackets had not been changed significantly, but because of inflation the top rate of 70% was being applied to real incomes of only about $281,000 (in today's dollars).

Congress enjoyed an annual tax increase without having to pass tax legislation. Yikes! Fortunately, with the Tax Reform Act of 1981, we began adjusting the brackets and rates to reflect inflation.- War. During wars we have always increased rates, except for 2001, when we began the war in Afghanistan, and 2003, when we began the war in Iraq. Instead of increasing rates, Congress passed tax cuts in these years.